are dental implants tax deductible in canada

Medical expenses are an itemized. Are dental veneers tax deductible in Canada.

Are Dentures Dental Implants Tax Deductible Calgary Dentures

Dental expenses includes fillings.

. Up to 15 cash back Are dental implants tax deductable in Canada. The good news is that will include all of your medical and dental expenses not just your dental implants. How to claim tax deductible for dental implants Canada.

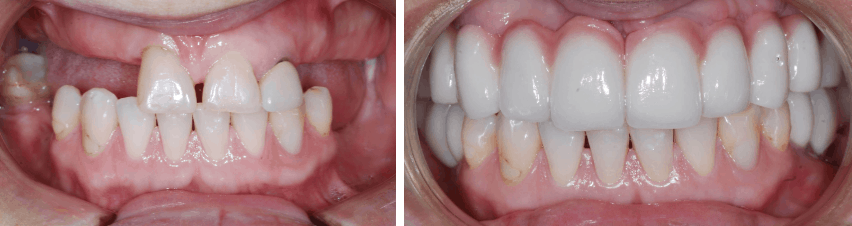

The good news is yes dental implants are tax deductible. In many cases it is more effective than health insurance especially for a costly event like dental implants or veneers. If you are NOT a small.

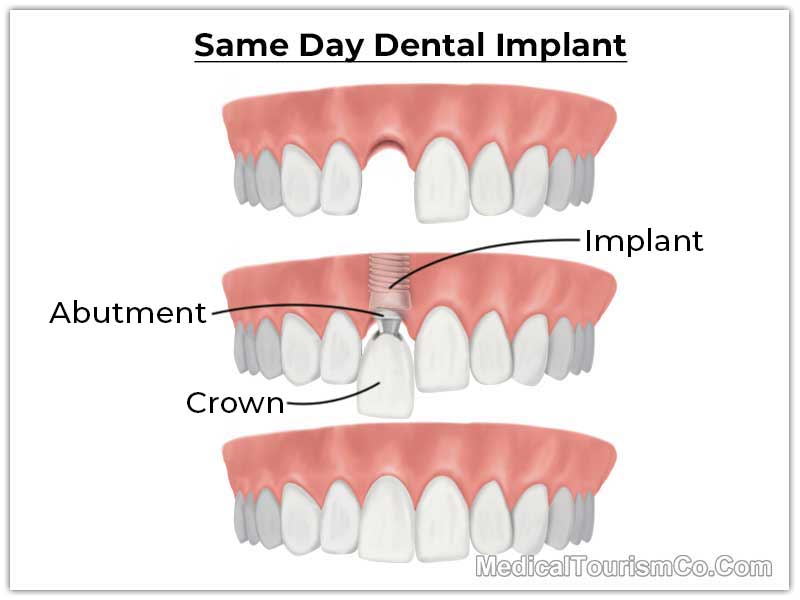

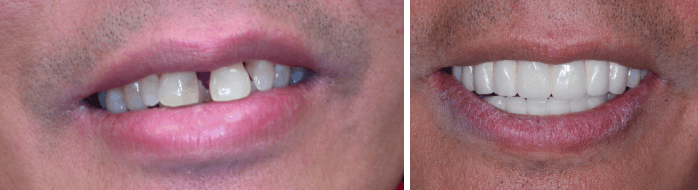

How to claim tax deductible for dental implants Canada. My implant procedure spreads 2022 and 2023. Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition.

22 2022 published 512 am. Comment sorted by Best Top New Controversial QA Add a Comment. You May Deduct Only The Amount Of Your Total Medical Expenses That Exceed 7.

There is a small catch though. Deduction for CPP or QPP contributions on self-employment income and other earnings. Please refer to original post.

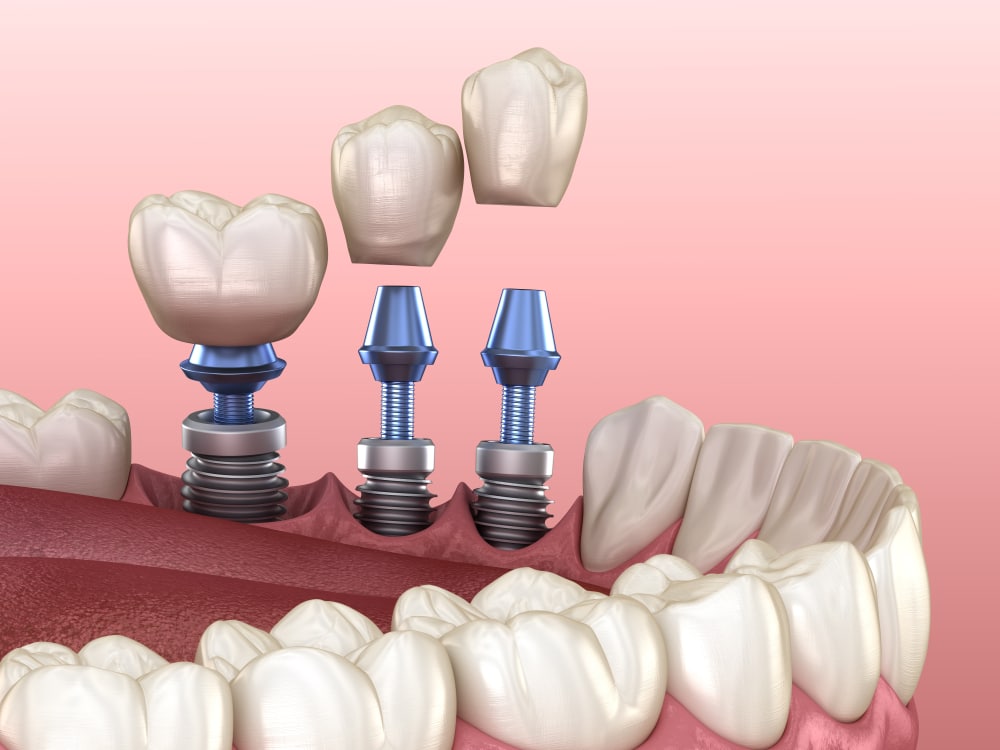

In another source a dental implant can cost anywhere in the range of 1500 to 6000. Yes dental implants are an approved medical expense that can be deducted on your return. I pay only half of the amount in 2022 and will pay off when it finishes in 2023.

Meanwhile a full mouth reconstructive dental implant will cost you up to. Teeth cleanings sealants and fluoride. Basically any treatment to prevent or alleviate dental disease is considered tax deductible.

The total of all itemized deductions must exceed this threshold for your dental implant expenses to yield any tax savings. To help you with this cost the canada revenue agency allows dental expenses to be used as medical. May 31 2019 855 PM.

Standard Deduction 2021 Single or Married Separately. Carrying charges interest expenses and other expenses. I am 79 years of age with no dependants other than my - Answered by a verified Canadian Tax Expert.

In Alberta Canada you can expect to pay anywhere between 900 to 3000 for a single dental implant. To help you with this cost the Canada Revenue Agency allows dental expenses to be used as medical expense deductions when you file your income tax. You can only deduct expenses greater than 75 of.

This includes the following procedures. If you dont have insurance that covers denture implants and dental implants the entire procedure is eligible as a medical expense on your tax return. Based on your annual income and other.

If you are 65 or over they are deductible to the extent they exceed 75 please click here for. Are Dental Implants Income Tax Deductible. Remember though that your itemized deductions for.

How To Get The Best Dental Insurance For Implants The Teeth Blog

Are Dentures Dental Implants Tax Deductible Calgary Dentures

Top Dentist In 91207 Dr Kim Blogs About Oral Care

Free Dental Implants For Recovering Addicts Grants For Medical

Dental Implant Cost Dental Implants Start From 900

Cost Of Dental Implants Abroad Best Country For Safe Affordable Implant Dentistry

Spring Cleaning 20 Hidden Tax Deductions You Ll Be Glad You Found 2022 Turbotax Canada Tips

Health Spending Account Cra Olympia Benefits Blog Health And Dental Expenses

Medical Expenses Why It S Worth Boning Up On This Tax Credit The Globe And Mail

Patients From The Us Faq Axis Dental Implants

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

Dental Implant Financing Good And Bad Credit Score Options Authority Dental

How Much For Dental Implants In Canada

Dental Implants Faq Vancouver Centre For Cosmetic And Implant Dentistry

100 Tax Deductible Dentistry Trusted Advisor

Are Dental Expenses Tax Deductible Dental Health Society

Dental Implants Faq Vancouver Centre For Cosmetic And Implant Dentistry